Stop Loss vs DCA

In general, I do not enable stop-loss and take advantage of Dollar Cost Averaging (DCA) on Cryptohopper. In most of the templates you will see that stop-loss is disabled but DCA is enabled. You can see the DCA settings in the hopper baseconfig under Selling > Dollar Cost Averaging.

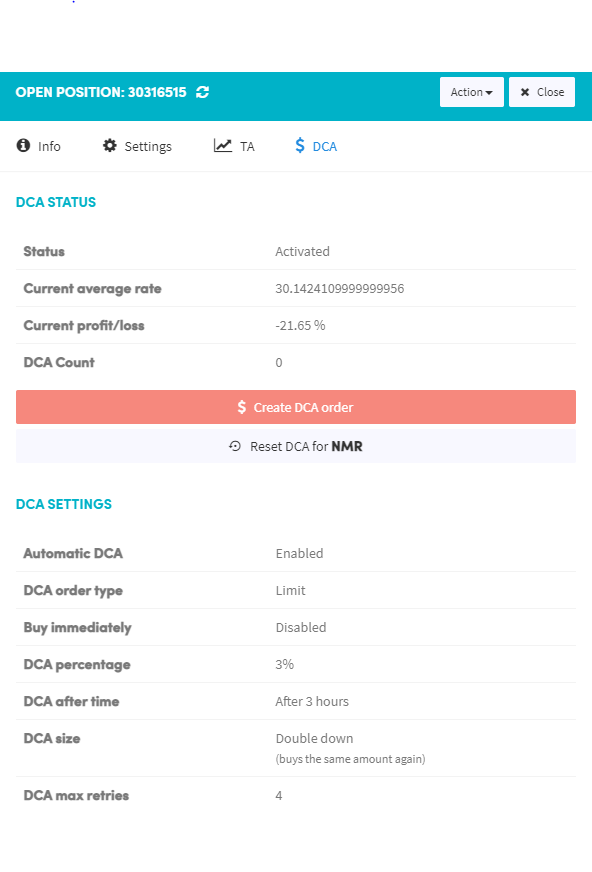

DCA is meant for those few orders that dropped into the negative and haven't sold in a few days. Rather than taking a loss at a particular negative percentage like you would with stop-loss, you can use the strategy's highly accurate market analysis to buy more of that coin and turn that potential loss into a profit. The way DCA is generally configured in the templates is to double down (buy twice as much of the currency that is currently in the negative) when the strategy signals a buy if that coin is below -3%.

Essentially think of it like this... For some unforeseen market/exchange/economic/mathematical reason, the strategy bought a coin and it didn't turn out to be profitable as soon as expected. The strategy is tested and optimized to make the correct buy/sell decision most of the time, and sometimes it gets it wrong, but most of the time it is right. The strategy messed up once and let's say you now have a -10% BTC position. Rather than using Stop-Loss and taking the guaranteed 10% Loss (or whatever stop-loss threshold you set), DCA gives you several chances to promote that currently negative position into a profit. This is done by holding onto that -10% BTC position until the the strategy signals a buy for BTC, and rather than opening a separate BTC position, your hopper will double the amount that you currently have in that -10% position. The hopper will convert that -10% BTC position into a "DCA" position and will reflect the doubled amount that your hopper purchased as well as show you the current profit/loss and the amount of times in which that coin has been doubled through DCA.

I've had DCA positions open for a week or two before finally turning a profit, but it's absolutely worth it because almost all DCA orders will eventually turn a profit if you are patient enough and allow the strategy to keep timing the proper buys. You essentially have a net-zero loss in the long run if you allow DCA to convert negative positions into profits.

Below is a screenshot of the DCA info on a position as an example:

| Views | |

|---|---|

| 48 | Total Views |

| 48 | Members Views |

| 0 | Public Views |

| Actions | |

|---|---|

| 0 | Likes |

| 0 | Dislikes |

| 0 | Comments |

Share by mail

Please login to share this webpage by email.